More concerned about a spike in oil than 5% Fed rate: Ritesh Jain

04 May 2023

If oil prices start pushing $90 per barrel and above, then Fed will

Ritesh Jain, co-founder of Pinetree Macro

Last night, US Federal Reserve Chair Jerome Powell delivered a 25 basis point rate hike on expected lines. Even as markets now believe that the rate hike cycle may be coming to an end, there is fear looming that the US may be heading towards a recession while inflation continues to be sticky and stubborn. Ritesh Jain, co-founder of Pinetree Macro, based out of Calgary in the US, talks about the rate trajectory going forward and the risk to global and Indian equities.

Excerpts from the interview:

Yesterday’s rate action was on the expected lines. Do you think we are at the end of the rate hiking cycle?

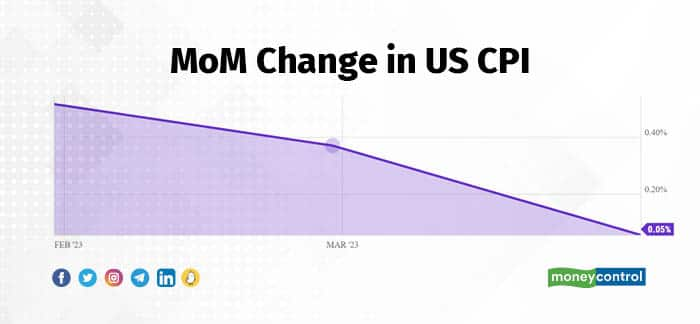

Yes, because month-on-month inflation in the US is flattening and year-on-year will be comfortably within the Fed range of 2-3 per cent by the third quarter of this year. Unemployment, which is the most lagging economic indicator, has started rising. Secondly, the US small and regional banks are losing bank deposits to large banks and money market mutual funds, and that means credit creation in the US is slowing down as we speak. Thirdly, the US has not been able to raise its debt ceiling and that effectively means that the US government will not be able to pay its bills starting May end and there is no light at the end of the tunnel as debt ceiling talks are dead-locked. This has already led to a spike in 1-year CDS in the US. All these reasons put together present a solid case for pause at the current levels itself. The only caveat I have is oil prices. If oil starts pushing 90 and above, then Fed will start becoming hawkish again.

Similar articles