Nifty, Sensex don't have tomorrow's winners, mid & smallcaps not in bubble territory, says this market veteran

08 Jan 2024

Our largecap benchmarks don’t represent tomorrow’s India. That’s because 55 percent of the benchmark weight is in services," said Ritesh Jain, co-founder, Pinetree Macro

Ritesh Jain, co-founder of Pinetree Macro

As India slowly moves from a service-led economy to a manufacturing-driven one, Ritesh Jain, co-founder, Pinetree Macro, believes that the country is simply ‘going back to basics’. In that backdrop, Nifty and Sensex do not capture tomorrow's winners, he said in an interview with Moneycontrol.

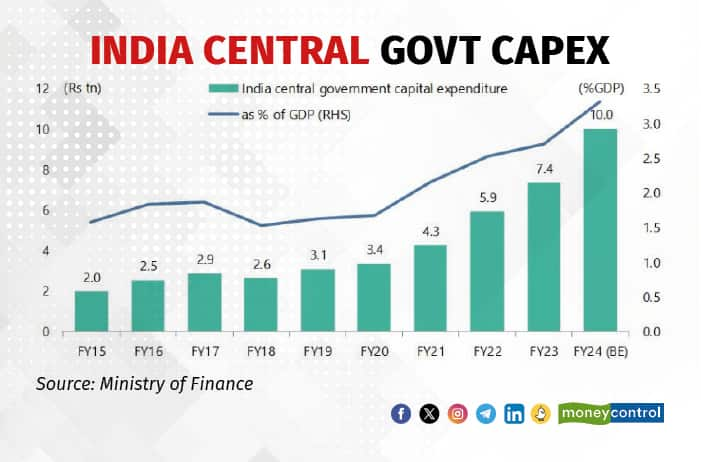

Government capex is in full throttle but the groundwork has been done for private capex to pick up now, which will largely come from mid and smallcap companies.

“What the Indian government has done, like Western governments, is create incentives for the private sector to take the lead on capex. Hence, I see capex picking up, although I can understand some hesitation to commit just ahead of the national election,” he said.

Government capex is in full throttle but the groundwork has been done for private capex to pick up now, which will largely come from mid and smallcap companies.

“What the Indian government has done, like Western governments, is create incentives for the private sector to take the lead on capex. Hence, I see capex picking up, although I can understand some hesitation to commit just ahead of the national election,” he said.

In a career spanning over 25 years, Jain has been associated with Canara Robeco AMC, Tata AMC, and BNP Paribas AMC among others. Edited excerpts from his interview:

Can you recap your two visits to India in 2023. What were the changes you noticed on the ground in your interactions with people?

My most recent visit to India in mid-November 2023 for four weeks was an eye-opener. There was “infectious optimism” in the air. There is no doubt that asset inflation—financial assets and gold—has liquefied the balance sheets of Indian households, but that has also emboldened them to increase their borrowing to spend more on current consumption. Uber owners are happier as they are seeing an increase in income. There is generally more optimism in Gurugram than in Delhi, as not only real estate asset prices have gone up in Gurugram, but business conditions are also better.

There is also a high degree of optimism due to the Delhi-Mumbai expressway. I strongly believe: Just make the roads, and growth will come. But mind you, manufacturing-related GDP growth and job creation in India have not happened yet. That cycle has yet to start. What we are seeing now is optimism, which is supported by asset prices. Going forward, I expect the optimism will be supported by real, all-rounded GDP growth in India.

Also Read: Budget 2024: All you need to know about National Savings Schemes

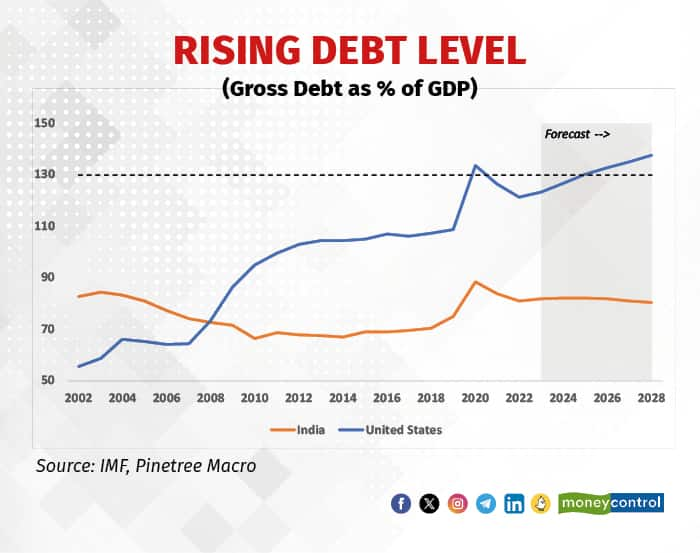

In this manufacturing push, the IMF has warned India's debt to GDP will exceed 100 percent by FY28. Do you see this as a concern? How are other comparable economies placed?

An increase in debt without an increase in income generally leads to lower future GDP growth. The entire Western world is now faced with high debt/GDP, with the US at 130 percent. Europe and Canada are also above 100 percent, with a very low increase in potential GDP growth. Hence, those economies are at great risk of falling into a debt trap. In India’s case, if we can continue to have 12–13 percent nominal GDP growth (6 percent real plus 6 percent inflation), then I won’t be too worried about IMF concerns.

As long as the numerator is growing faster than the denominator, you can inflate the debt. The only way India gets into the debt trap is when it stops growing its GDP by 5–6 percent.

Your broad sense is that India is moving from a service-led economy to one driven by manufacturing. What pockets of manufacturing do you think India will be able to capture or dominate?

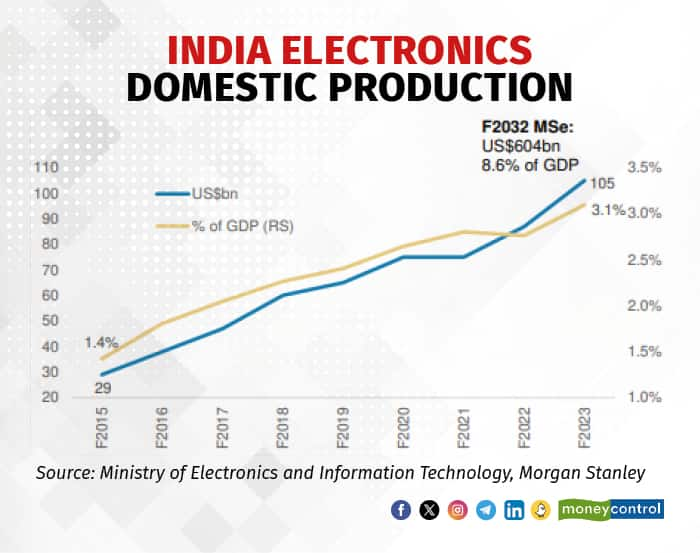

The one that is clearly visible and is already captured in graphs, given the blow, is the success story of electronics manufacturing.

Morgan Stanley believes India’s electronics manufacturing sector will be growing at a 21 percent CAGR over the next 10 years to $604 billion, and by FY32, it will be 8.6 percent of GDP, supported by a large and growing consumer market, a strong policy environment, a low-cost labor supply, and the re-shoring of supply-chain diversification initiatives.

Morgan Stanley believes India’s electronics manufacturing sector will be growing at a 21 percent CAGR over the next 10 years to $604 billion, and by FY32, it will be 8.6 percent of GDP, supported by a large and growing consumer market, a strong policy environment, a low-cost labor supply, and the re-shoring of supply-chain diversification initiatives.

The others where I am quite bullish are the ones where PLI is getting attractive. A few others that come to mind are defence indigenisation, where we are not starved of technology transfer, and electrification because we need to move away from fossil fuels.

Electrification is also my macro theme of the decade, and here I will quote a statement from Hitachi Energy India CEO,

“In India, it also means adding an equivalent of the European Union’s entire existing grid by 2040.”

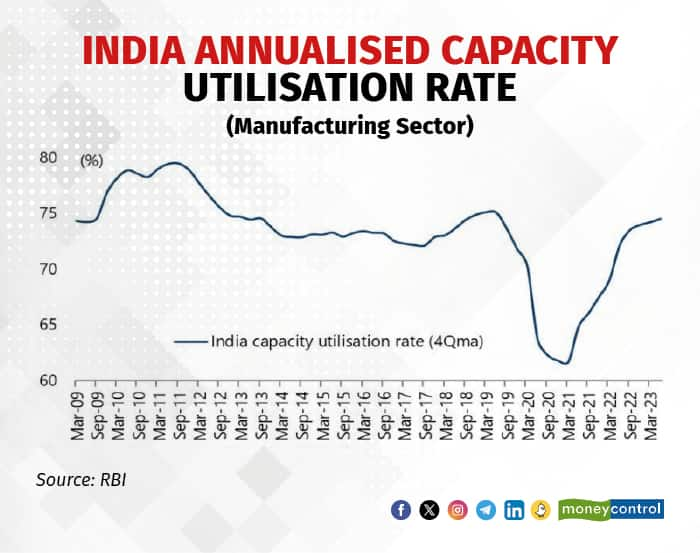

Also, if you look at the chart below, it is the perfect storm brewing for the private sector to finally take the baton from the government.

With so many incentives to pivot towards manufacturing, it is a matter of time before we start seeing private sector capex as capacity utilisation starts hitting a level consistent with increasing capex.

Electrification is also my macro theme of the decade, and here I will quote a statement from Hitachi Energy India CEO,

“In India, it also means adding an equivalent of the European Union’s entire existing grid by 2040.”

Also, if you look at the chart below, it is the perfect storm brewing for the private sector to finally take the baton from the government.

With so many incentives to pivot towards manufacturing, it is a matter of time before we start seeing private sector capex as capacity utilisation starts hitting a level consistent with increasing capex.

Capex has been driven by the government so far. When do you think this shift from government capex to private capex will play out? Do you feel the government's balance sheet will be constricted in pursuit of the fiscal deficit target?

You are right.

Capex has been driven not only by the Centre but also by the state governments and is now being constrained by government balance-sheet capacity. What the Indian government has done, like Western governments, is create incentives for the private sector to take the lead on capex. Hence, I see capex picking up, although I can understand some hesitation to commit just ahead of national elections.

Capex has been driven not only by the Centre but also by the state governments and is now being constrained by government balance-sheet capacity. What the Indian government has done, like Western governments, is create incentives for the private sector to take the lead on capex. Hence, I see capex picking up, although I can understand some hesitation to commit just ahead of national elections.

Do you think midcaps and smallcaps are in bubble territory?

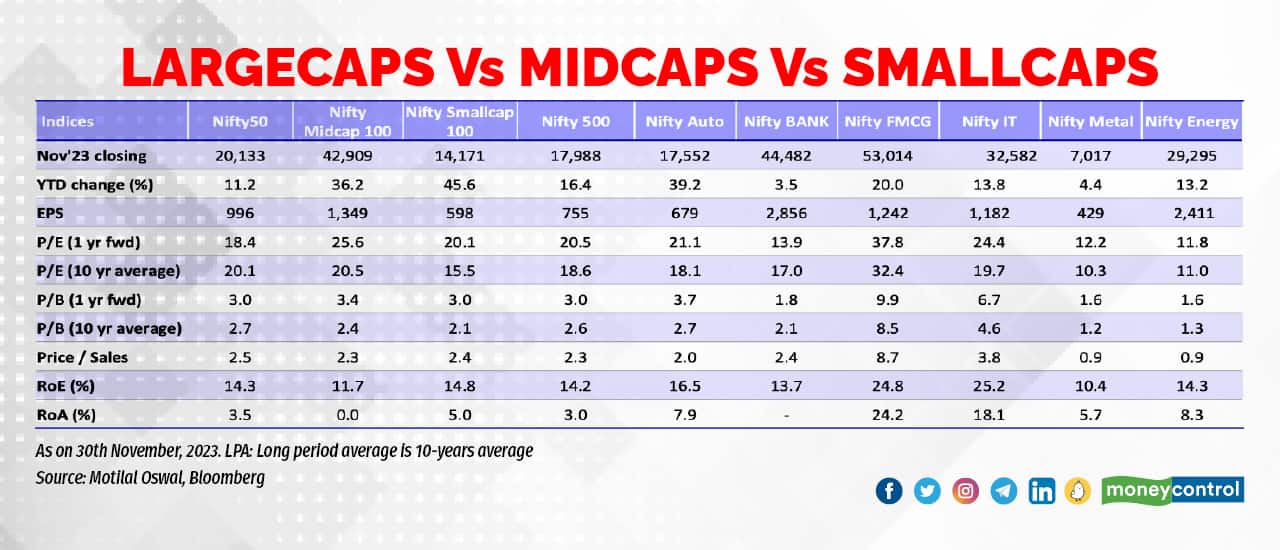

Overvalued yes, but not in the bubble category.

Our largecap benchmarks don’t represent tomorrow’s India, in my view. That’s because 55 percent of the benchmark weight is in services. What India is trying to do is pivot towards manufacturing, and as per some estimates, manufacturing creates five times more jobs than services. If electronics manufacturing alone will move from 3 percent of India’s GDP in 2023 to 8.6 percent of GDP in 2032, can you visualise this transition?

Most of the beneficiaries of tomorrow’s India are not in largecap benchmarks, and I would argue that looking at benchmark valuations alone is of no use in the current environment. So, we can get a time or price correction at any time, but I think just looking at valuations at the benchmark level and correlating them to the past is of no relevance.

Our largecap benchmarks don’t represent tomorrow’s India, in my view. That’s because 55 percent of the benchmark weight is in services. What India is trying to do is pivot towards manufacturing, and as per some estimates, manufacturing creates five times more jobs than services. If electronics manufacturing alone will move from 3 percent of India’s GDP in 2023 to 8.6 percent of GDP in 2032, can you visualise this transition?

Most of the beneficiaries of tomorrow’s India are not in largecap benchmarks, and I would argue that looking at benchmark valuations alone is of no use in the current environment. So, we can get a time or price correction at any time, but I think just looking at valuations at the benchmark level and correlating them to the past is of no relevance.

The biggest risks to India in 2024

I have always believed that the biggest risk for India is federal elections. The post-COVID world is a different world, and in this world, governments have become a bigger part of the economy at the expense of the private sector. Governments are deciding winners and losers, and reallocating resources, which has not happened before to this extent. Global capital flows into India will depend on government policies’ continuance.

Think of India as an asset class, but every asset needs a missionary to popularise that asset. The elected head of the Indian government is that missionary; hence, elections are the biggest risk. Outside of that, I believe we need to keep an eye on and recalibrate policies in case oil prices spike.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Think of India as an asset class, but every asset needs a missionary to popularise that asset. The elected head of the Indian government is that missionary; hence, elections are the biggest risk. Outside of that, I believe we need to keep an eye on and recalibrate policies in case oil prices spike.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Similar articles