Months of discussion and speculation culminated in what is turning out to be a big booster for the markets – the India-US trade deal. “Markets dislike uncertainty, and the removal of this uncertainty provides a much-needed sentiment boost,” - Ritesh Jain.

The big highlight is India’s consent to not buying Russian Oil. Instead we agreed to buy more of the US and Venezuelan crude from the U.S. India also committed to 'BUY AMERICAN,' at a much higher level - India agreed to buy over US$500 bn of US energy, technology, agricultural, coal, and many other products. However, that seems a tall task and has to be long-term some way in future considering that India’s imports of US goods stood at USD45 bn in 2025. India has agreed to move forward to reduce its tariffs and non-tariff barriers against the US to “ZERO”.

What did we get in return?

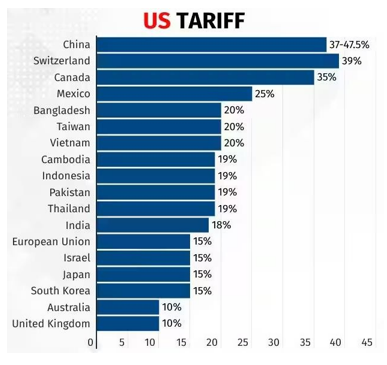

The US will still charge a Reciprocal Tariff but it is lowered to 18% from 25%. The earlier 50% levy on Indian goods comprised two parts:

- 25% reciprocal tariff and

- an additional 25% import duty imposed on India’s purchase of Russian crude oil.

Under the new arrangement, the US has withdrawn the punitive duty linked to Russian oil imports and lowered the remaining reciprocal tariff, bringing the overall rate down to 18%. In effect, therefore, the tariff stands at 18%. Made-In-India products will now attract only 18% tariff. The revised rate represents a significant easing of trade pressure after months of elevated duties on Indian exports.

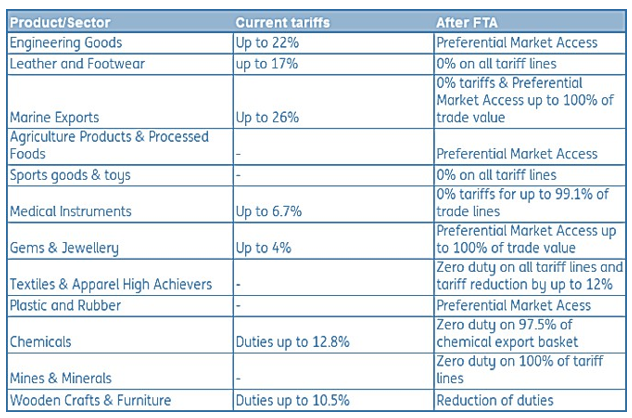

The deal is expected to benefit such sectors as the textile space, shrimp feed exporters, Gems and Jewellery companies, among others having exposure to the US market. The deal, however, will not impact the sectors that fall under the ambit of Section 232 the U.S. Trade Expansion Act of 1962, which allows the President to adjust imports of goods such as steel, aluminum, and semiconductors if they threaten national security. These sectors will continue to face higher tariffs. Available data indicates that 10% of India's exports translating to over $8 billion worth of exports may still face higher tariffs. Sectors include Automobiles, Steel, Aluminium, Timber, Copper and trucks & ships. Autos constitute the biggest exposure to Section 232 with shipments worth nearly $4 billion. The deal will boost American farmers as it indicated opening up of agro-products categories, though it is still ambiguous which categories would actually be opened up.

Source: Moneycontrol

The deal puts India in a relative advantageous position over several competing export economies in the region. Its tariff rate is now lower than those applied to Indonesia, Bangladesh and Vietnam. India's exports face significantly reduced US tariffs in comparison to China and Pakistan, which is expected to strengthen India’s position in major global supply chains.

“There was a lot of pessimism around Indian equities over the past year. India did not participate meaningfully in the global rally, and foreign money steadily moved out of domestic markets. Some portion of that capital can now return.” – Ritesh Jain

According to US leaders are of the opinion that the trade deal announced by US President Donald Trump with “close partner” India will facilitate higher export of farm products from America to the huge Indian market and the agreement will also help counter Russian aggression.

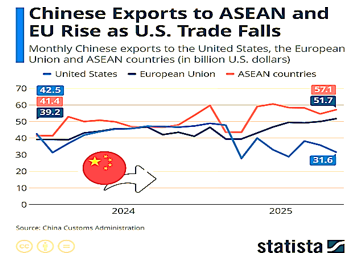

India is however looking to diversify its export basket

India is however started to find out ways to diversify its export basket and the recent trade agreements with EU, UK, Oman and with Australia in 2022. Negotiations are going on with New Zealand as well. India is expected to follow footsteps of China which has diversified its export basket and lowered dependence on USA, a strong strategic move.

Source: Moneycontrol

Putting the EU FTA in Perspective

The FTA signed with EU, being referred to as the "mother of all deals" gives India sweeping duty-free access to the EU, effectively neutralising Pakistan's advantage over India. The deal is set to grant duty-free access to 99% of Indian exports from the first day of its implementation.

India-UAE Agreement

Couple of weeks ago India signed $3 bn LNG agreement with UAE. Under the new deal, Abu Dhabi state oil firm ADNOC will supply LNG of up to $3 billion for a period of 10 years, starting 2028, to India’s state- owned Hindustan Petroleum Corporation. Trade between India and UAE touched $100 billion in fiscal year 2025. Both countries signed the Comprehensive Economic Partnership Agreement in 2022. The trade Partners mutually agreed to double bilateral trade to $200 billion by 2032. This agreement was aimed at diversifying India’s trade, following the imposition of tariffs by the U.S. on its exports.

How will it impact India?

To start with 50% tariffs imposed on India was sentimentally extremely weak for India and which resulted in exodus of FIIs and impacted the Indian rupee. The rupee is expected to stabilize now however the present levels are reasonable and we are unlikely to return to 85 levels but somewhere closer to 90.

There is a strong case for re-rating of the Indian markets considering that:

- India offers macro stability with nominal GDP growth projected at 10% for FY27 and which has now chance to better than those estimates

- Govt. has continued to support higher capex in the Union Budget and strong focus on manufacturing and that goes well with the trade deals signed

- The Govt. has earlier provided fiscal measures for fueling consumption through GST cuts (₹1.8 lakh crore) and income tax slab rationalization (~₹1 lakh crore) and 8th pay commission will provide further boost to Govt. employees.

- Monetary policy which was tight, has now started to focus on liquidity under the new RBI Governor

- Indian equities are attractively priced compared to historical averages and bodes well in the mix of things and given the rupee levels, makes a strong case for comeback for FIIs.

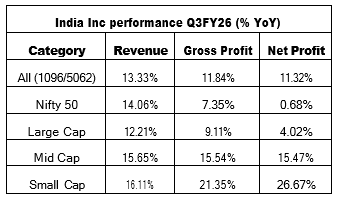

- The earnings for Q3FY26 so far has witnessed double digit revenue growth, which was missing in the past 2-3 quarters. However, profitability in key sectors has been impacted due to implementation of labour code. Overall, 1096 out of 5062 companies have declared results and clearly small caps have performed better than midcaps and midcaps than large caps, which is very healthy given investor apathy towards midcap and smallcap space.

Source: Moneycontrol

- Moreover, India Inc. is expected to report earnings growth of 13-14% in FY27, which is expected to be revised upwards in the context of the new trade deals

Sources: Moneycontrol, Statista, Economic Times, Financial Express.

Research Analyst

Partha Mazumder (partha@easternfin.com)

Sanjukta Majumdar (research@easternfin.com)

Research Team

Partha Mazumder (partha@easternfin.com)

Sanjukta Majumdar (research@easternfin.com)

Sayantina Mallick Chowdhury (sayantina@easternfin.com)

Disclaimer

Eastern Financiers Limited (hereinafter referred to as ‘EFL’) (RA Registration No: INH000022756, Type: Non- Individual) is a Member registered with SEBI having membership of NSE, BSE, MCX. It is also registered as a Depository Participant with NSDL. It is also having AMFI certificate for Mutual Fund Distribution. The associate of EFL is engaged in activities relating to Insurance Broking. No disciplinary action has been taken against EFL by any of the regulatory authorities. EFL/its associates/research analysts do not have any financial interest/beneficial interest of more than one percent/material conflict of interest in the subject company(s). EFL/its associates/research analysts have not received any compensation from the subject company(s) during the past twelve months. EFL/its research analysts have not served as an officer, director or employee of company covered by analysts and has not been engaged in market making activity of the company covered by analysts. This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. EFL or any of its affiliates/group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. EFL has not independently verified the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While EFL endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory compliance or other reasons that prevent us from doing so. The report is for information and education purposes only. It must not be construed as any solicitation of any investment or any BUY/ SELL/ HOLD recommendation. Investments are subject to market risk. The user must do his/ her own research before taking any investment decision. Eastern Financier Limited is not liable for any consequence of any action taken by the user on the basis of this report.